We’ve gathered a list of the top 5 meal kit companies in the U.S. Although there are hundreds of smaller companies in the space, market concentration is high, with the top four companies generating more than 70% of industry revenue. On top of that, the king of the sector is HelloFresh with revenue figures that dwarf its competitors and leaves the rest of the pack playing catch up..

A 2023 study estimates the U.S. meal kit delivery reached $12.87 billion in 2024. Looking ahead, the sector is projected to reach $23.71 billion by 2030, growing at a compound annual rate of 10.7%. This robust growth depends on increasing consumer adoption of meal kit services as a convenient solution for home cooking.

Only HelloFresh is a stand-alone public company and their financial reports provide global revenue figures. Home Chef is part of Kroger but revenue figures are industry estimates, as are the remaining company revenue figures since they are part of privately held corporations.

- HelloFresh – Revenue: $5.43 billion (Estimate of U.S. Revenue Alone)

HelloFresh continues to lead the meal kit market with a robust revenue of $8.59 billion. Offering a diverse menu that caters to various dietary preferences, HelloFresh has become synonymous with meal kit convenience, bringing fresh ingredients and easy-to-follow recipes to dining tables across the U.S. - Home Chef – Revenue: $777.6 million (Annual Estimate)

Home Chef, with an estimated annual revenue of $777.6 million, has made its mark with customizable meal options. Acquired by Kroger in 2018, Home Chef has access to an extensive retail footprint, allowing for a seamless integration into grocery shopping experiences both online and in-store. This acquisition has bolstered Home Chef’s reach, offering even more consumers the chance to enjoy personalized, chef-designed meals. - Blue Apron – Revenue: $424.92 million (Last 12 months ending Q3 2023)

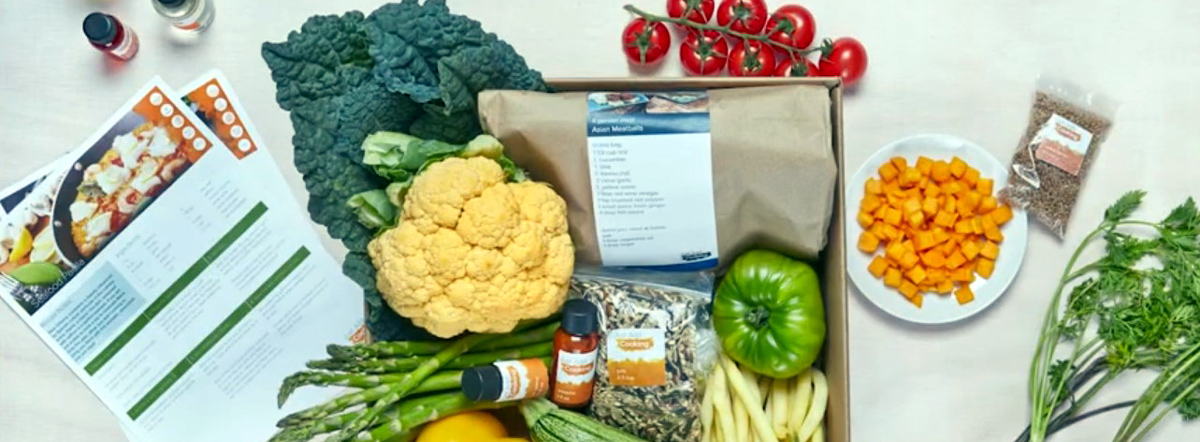

Blue Apron, generating $424.92 million in revenue, focuses on culinary education and sustainability. Known for its detailed recipe cards and seasonal ingredients, Blue Apron has maintained a dedicated customer base by providing a learning experience with every meal kit. The company has strategically expanded beyond its subscription model through a partnership with Walmart Marketplace in June 2022, becoming the first and only meal kit provider on the platform. In November 2023, Blue Apron was acquired by Wonder Group for $103 million. - Sun Basket – Revenue: $107.3 million (Annual Estimate)

With an annual revenue estimate of $107.3 million, Sun Basket focuses on organic, non-GMO ingredients, catering to a health-conscious clientele. Their commitment to sustainability and dietary inclusivity has carved out a niche for those seeking meals that are both nutritious and environmentally friendly. - Green Chef- Revenue: $105 million (Annual Estimate)

Green Chef focuses on providing mostly organic, sustainably sourced ingredients and recipes for health conscious consumer. the company faces challenges from larger competitors and changing consumer preferences.

Headwinds Ahead?

Despite expected continued growth for these meal kit companies it’s not all smooth sailing ahead. They all have significant churn rates with nearly 50% of customers canceling their subscriptions within the first month and only 20% sticking around for the long-term. Plus, the industry is plagued by high operational costs, intense competition from over 350 other smaller meal kit companies in the US, and a shifts in consumer behavior since the pandemic. To make matters worse, only 30% of customers are profitable.

Another issue facing these companies is how to compete with the rise of restaurant delivery services and grocery alternatives is further disrupting the market. While ‘meal kits’ and ‘food delivery’ (Uber Eats, DoorDash, etc) operate under different value propositions, there’s considerable overlap in how they meet consumer needs, compete for consumer attention, and adapt to market trends. The lines between these industries are becoming increasingly blurred as each sector borrows elements from the other to cater to a wide array of consumer preferences. However, at their core, they remain separate in terms of the experience they provide and the type of consumer engagement they foster.